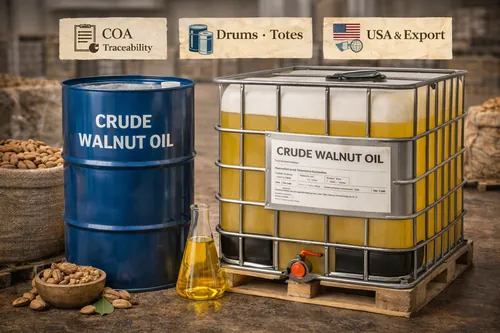

Bulk Crude Walnut Oil

Atlas Nut Supply, LLC supplies bulk crude walnut oil for manufacturers, blenders, and ingredient buyers that need a predictable procurement lane—not a one-off spot buy. We cooperate with multiple California processors and bulk programs to match your quality specification, packaging, documentation, and delivery requirements for domestic U.S. routes and export.

Crude oil programs are typically qualified around oxidation stability and downstream process fit. If you’re blending, refining, deodorizing, or running an industrial formula, share your FFA/acid value, peroxide value (PV), color/odor expectations, and receiving constraints—then we’ll align the right program.

Request a quote Specs checklist Spec table Back to catalog

Fastest quoting: share FFA/acid value max, PV max, target odor/color, packaging (drum/tote), volume, destination (and port if export), and required docs (COA/traceability/COO/certs).

Looking for other walnut formats? See bulk walnut products (kernels, pieces, meal, and more).